info@torontoenergyaudit.ca (647) 640 7778

Loan details

Eligibility

How to apply

IMPORTANT: You should not start any retrofit work before your loan application has been submitted. Any retrofits started before submitting your loan application are ineligible.

Loan details

The Canada Greener Homes Loan offers interest-free financing to help Canadians make their homes more energy efficient and comfortable.

The loan can help you finance eligible retrofits that are recommended by an energy advisor and that have not yet been started.

Maximum: $40,000

Minimum: $5,000

Repayment term: 10 years, interest-free

Loan type: Unsecured personal loan on approved credit

A maximum of one loan is available per eligible property and homeowner.

The maximum eligible loan amount is calculated based on the retrofits selected in the application and the quotes for this work. The eligible amount is capped based on industry standards and market norms. The maximum eligible loan amount may be less than your quoted cost, in which case you will be responsible for funding any difference.

Once approved, a portion of the loan can be delivered up front to assist in paying any deposits required by your contractor. The balance of the loan will be delivered after the retrofits have been completed and verified through a post-retrofit evaluation.

You cannot apply for a loan for the following:

Eligibility

All loan applicants

There are some eligibility requirements to meet before applying for the loan:

- You must be a Canadian citizen, permanent resident, or non-permanent resident who is legally authorized to work in Canada

- You must own the home and it must be your primary residence

- You have a pre-retrofit evaluation and have not yet had a post-retrofit evaluation

- Your pre-retrofit evaluation was completed on or after April 1, 2020

- You have not started the retrofits for which you are seeking a loan

- You have a good credit history and are not in:

- a consumer proposal

- an orderly payment of debt program

- a bankruptcy or equivalent insolvency proceeding

Low-rise multi-unit residential buildings

Individual homeowners living in a low-rise multi-unit residential building (MURB) must meet the additional eligibility criteria for MURBs.

Loan application tips

Ensuring your application is complete and accurate will improve processing time and allow you to start your retrofits sooner.

- You cannot start any work until your loan application has been submitted. Any retrofits started before submitting your application are ineligible.We recommend that you do not start any work before your loan application has been approved. If you choose to begin your retrofits before your loan application is approved, you are responsible for all costs if your application is declined.

- Submitting an application with incomplete and/or inaccurate information will cause delays. Do not submit your loan application with missing documents or incomplete information.

- Your loan application must include all retrofits that you plan to complete. Retrofits that are not included in your loan application cannot be added later.If you include retrofits in your application that you later decide not to complete, these will be subtracted from your loan before final funding. The adjusted loan amount must be at least $5,000 to remain eligible.

- Make sure that the quotes from contractors are clear and show the cost of the eligible energy efficient retrofits.

The maximum eligible loan amount is calculated based on the retrofits selected in the application and the quotes for this work. The eligible amount is capped based on industry standards and market norms. The maximum eligible loan amount may be less than your quoted cost, in which case, you will be responsible for funding the difference.

Upfront costs

Once approved, up to 15%* of the loan can be delivered up front if a deposit is required by your contractor. The initial advance is only available for retrofits that require a deposit. The balance of the loan will be delivered once the retrofits have been completed and verified through a post-retrofit evaluation.

You can request the initial advance during your application by uploading the quotes from contractors and entering the deposit amounts required to do the retrofit.

*The initial advance is increased to 25% if your property is located in the North or off-grid.

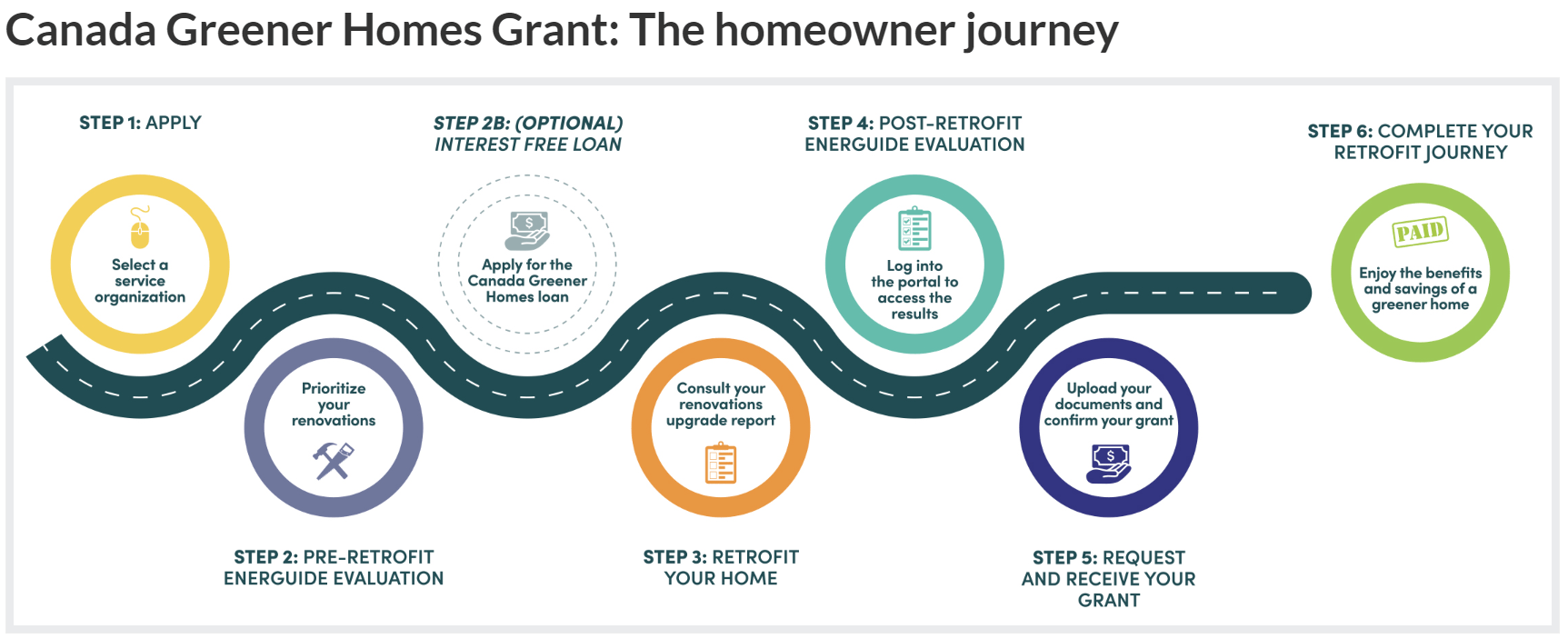

How to apply

- 1

An energy advisor will evaluate your home and make recommendations on how to make it more energy-efficient and resistant to climate change. Only eligible retrofits that have been recommended by an energy advisor are eligible for the loan.

- 2

Plan your retrofits and obtain quotes from contractors

- 3

Submit your loan application before starting any work

- 4

Complete your retrofits

- 5

Get a post-retrofit evaluation

- 6

Request final loan advance

- 7

Receive your loan amount

- 8

Repay your loan over time

recent projects

Crafting the high quality products you can trust, Serving you better since 1995!